As such, index funds have become the favorite of the novice investor since they are pretty easy to use, with low costs and represent one of the best ways for long-term wealth buildup. You may get access to the equity market with an index fund without having to keep track of many individual stocks. Here, we tell you why index funds

are good investments for novices and how to make the most of them.

What are index funds?

An illustration would be an index fund, which is simply a particular type of

exchange-traded fund or mutual fund designed to replicate the performance of a

certain stock market index, such the S&P 500. Stated differently, an index funds

tracks all, or a proportionate sample of, the stocks in the index it is monitoring rather than trying to identify individual winners.

This means that to get highly diversified portfolios, investors have to do little more than this.

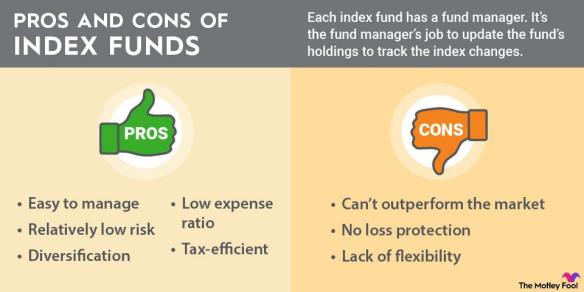

Advantages of Index Funds

• Low Fees

The main reasons you like index funds is that they are cheap. Compared to actively managed funds, they have lower management fees because they are passively

managed. Over the long term, this lesser drag will add hugely to your overall returns.

• Stability and Long Run Growth

Long-term investors mainly need index funds that guarantee a smooth growth over the long term. Throughout history, the stock market major indexes have had sound returns and thus are at their best to pick with growing wealth in increments.

• Ease

For one just starting out in the market, index funds make perfect sense and also

pragmatic. You do not have to know how specific companies really work. Moreover, you don't have to be a market timing pro.

Once you purchase an index fund, you expose yourself to the all-around performance of the market.

Why Index Funds Are Great for New Investors

• Lower Risk

Since index funds provide broad diversification instead of particular stocks, they are not risky. This means that, as a result, beginners, in this case, those with no

experience or enough time to scrutinize the particular companies, will appreciate the reduced risk that such an investment in the index fund attracts.

• Cost-Effective

Because of low fees attached to index funds, investors-even the smallest quantities of capitals-will find them very affordable. Most index funds have very small minimum investment requirements and are therefore open to any size investor.

• Not Subject to Active Management

The greatest advantage is that there's never constant fiddling with or frequent

buying and selling. This benefit is particularly well helped to a new investor since it keeps them from staying busy overreaching about short-term market correction

versus growth.

• Compound Interest

Since an index fund is a long-term investment, you benefit from compounding.

Value increases and reinvests because of the rise in dividend growth, and therefore, the investment compounds over time.

How to Begin Investing in Index Funds

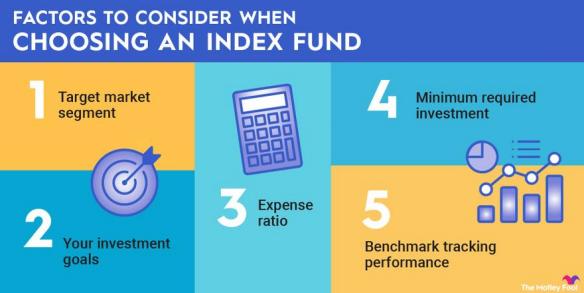

• Picking the Suitable Index

Well, there literally are hundreds of variations of index funds you can choose from,

each tracking a different index. A good place to start for a beginner is something like the S&P 500, which most closely represents as large a cross-section of industries as possible.

• Open a New Investment Account

Open a brokerage account or even open the investment directly with the mutual fund company. Many online brokers now offer commission-free trading on index funds to make it easy and inexpensive to get started even if you have little

experience.

• Automate your investments

•

•

One of the simplest ways to invest in index funds is to put in a systematic

investment plan: you agree to have some amount withdrawn from your account each month. In this way, you avail yourself of the dollar-cost averaging principle, which should go some way in dampening the effects of volatility on your returns.

• Stick to your guns

An index fund is a long-term investment. In fact, there will be increases and

decreases in market value. But the point behind earning some return from an

investment is through holding that investment over a period of time. Do not get tempted to sell when the market turns adverse; keep your eyes on long-term

financial goals and do not let yourself fall in line when the market bottoms.

Conclusion

A great choice for the new investor, as well, as it makes investing so much more

palatable because it's simple, costs nothing, and diversifies. Invest in an index fund today; let the long-term growth of the stock market take care of the rest of it. Saving for retirement, maybe just trying to build wealth for the future? Whatever the impetus, here's the rock you can build your financial castle on

Understanding the Pros and Cons of Investing in Frontier Markets

Market Turmoil Escalates as Hedge Funds Stage Massive Sell-Offs for Survival

How to Invest in International Markets

Why are index funds appropriate for a new investor?

The Rise of Business Models of Subscriptions

Critical Illness Insurance: A Comprehensive Guide for the Discerning Investor

Insurance Guide: Tailored for Life's Phases